Tax Smart Giving

Increase your impact and tax benefits, it's a win-win!

*This information is not intended to be a substitute for specific individualized tax advice and we suggest you discuss your specific tax issues with a qualified tax advisor.

Step by Step's Entity Identification Number/Tax Identification Number is 61-1313872

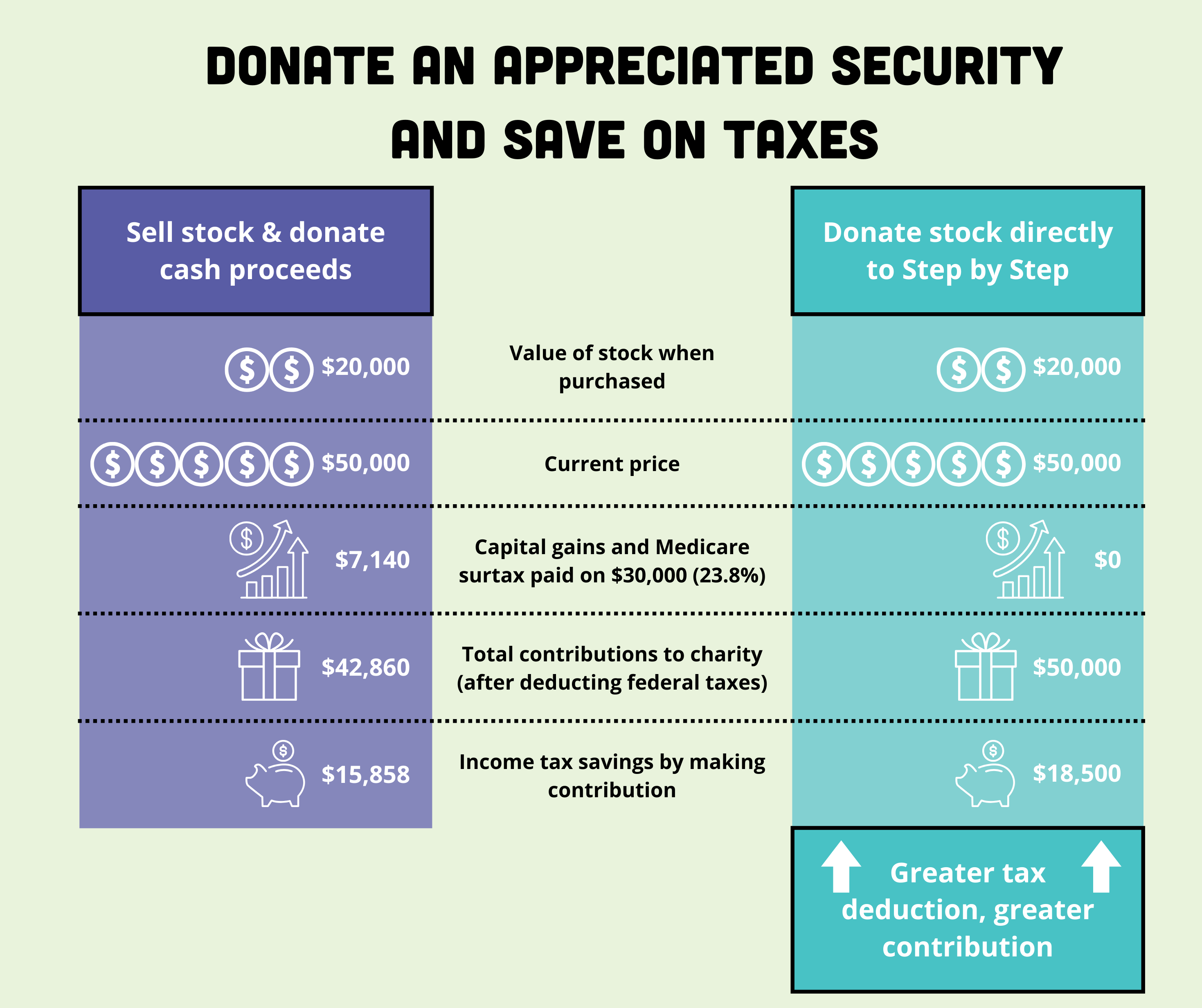

1. Stocks or Appreciated Assets

By donating stocks or appreciated assets, you can avoid capital gains taxes, which makes this method financially advantageous for you. Simultaneously, Step by Step receives the full market value of the donated assets, making your contribution even more significant.

DTC WIRING INSTRUCTIONS FOR GIFTS OF STOCK OR BONDS

DTC Eligible Securities

DTC # 0075

LPL Financial (Broker Dealer)

For Further Credit to LPL Account Number: 1454-2192

For Further Credit to LPL Account Name: Step By Step, Inc.

2. Qualified Charitable Distributions (QCDs)

If you are 70½ years old or older, you can make QCDs directly from your individual retirement account (IRA) to Step by Step. QCDs are not considered taxable income and are counted towards your required minimum distribution, offering a great tax advantage.

3. Donor-Advised Funds (DAFs)

Step by Step is pleased to accept gifts in the form of grants from DAFs, a philanthropic vehicle that allows you to contribute cash, securities, and other assets to charitable organizations. The benefits of a DAF include simplicity, flexibility, tax efficiency, and the ability to grow your investment tax-free.

Legacy Giving

Would you like to leave a legacy at Step by Step through planned giving? Ensure you make a lasting impact to continue for years to come. We're happy to help you reach your legacy goals so you can continue your generosity, care for those you are leaving behind, and take advantage of tax benefits.

For financial planning assistance with Tax Smart Giving, contact Seth Salomon at Salomon & Company.